Be In It for the Long Haul

Some of you know that I was an Investment Manager and Financial Planner for 15 years, working in a top three wealth management company. Since I am no longer licensed by the Securities and Exchange Commission, I’m hesitant about giving specific investment advice. However, let me provide some general advice that applies to many folks.

Before I get into the nitty gritty of the investment process, here are some comments I’ve often said to my clients:

- Save first and then spend.

- Increase your savings percentage over time as your income increases.

- If your finances change, adjust your savings and retirement account percentage, but don’t stop saving.

- Always have an emergency fund and a retirement account.

- I am an advocate of working with a Financial Advisor (historically called a “stock broker”)

- They have access to many types of investments.

- Their advice is personalized to your finances and your needs.

- Research shows that working with a financial professional increases net returns on your investments because it takes your emotions out of investing.

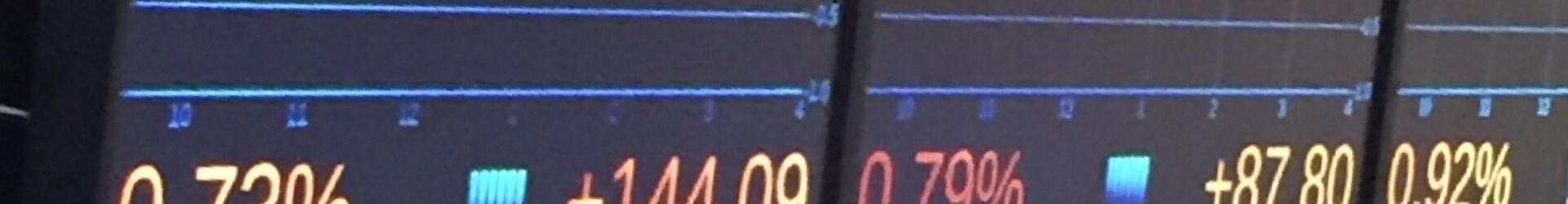

Now let’s focus on your retirement investments which you’ll need in 10-20-30 years. Many people are anxious and uncomfortable with the natural (and normal) volatility of the stock market. Let me provide an illustration:

Tiffany and Ashton own a home in which a lighted sign alerts them of the current market value of their home. Whenever the market value of their home goes down, the sign alerts them of the reduced market value and flashes in BIG RED LIGHTS. For weeks, the red lights continue flashing, causing Tiffany and Ashton to get nervous. The value of their home is plummeting. They finally panic and sell their home so that they will not lose more market value. Whew – are they relieved? No more panic.

Clearly, they let their short term fears blind their decision-making which impacted the long term investment of their home.

When you buy a home YOU’RE IN IT FOR THE LONG HAUL. When you deposit money into your retirement investment account, YOU’RE IN IT FOR THE LONG HAUL. Your retirement account, like your home value, has daily, monthly and annual fluctuations. Remember, your primary concern is the future balance of this account, not today’s value.

The farther away you are from retirement, the less concerned you need to be about the ups and downs of your investments. There’s an old adage that says, “It’s the time in the market that counts, not timing the market.” So, put your crystal ball away, continue to make contributions to your retirement account each paycheck and review your account once or twice a year.

In future articles, we’ll talk more about retirement investments including the concept of a “well-balanced portfolio”.